Are you considering using the Business Exits brokerage to sell or buy a business? Before you make a decision to use this firm, see what we’ve uncovered in our extensive Business Exits review.

UPDATED: April 2024

Our Overall Rating

Overview Of Business Exits

Business Exits is a business brokerage firm that was started in 2013 by Jock Purtle who is also an entrepreneur giving him business experience that some may not have.

This business broker is considered a boutique mergers and acquisitions business that focus mainly on retiring founders. They specialize in businesses that have revenue between $2 million to $25 million. This means they typically focus on selling larger businesses and deal with only larger deals.

At the time we wrote this Business Exits review the team at Business Exits consisted of three business brokers along with a small staff that help to make sure deals get done properly. It’s not a large team of brokers as you see at Transworld Business Advisors or Sunbelt Business Brokers, but having many business brokers does not always mean great service. There are times that smaller firms give a much more personalized experience as is the case with Website Properties.

For Sellers

According to the Business Exits website, they have the best appraisal resources to help sellers determine the value of their business. Having a good valuation is very important to make sure sellers have realistic expectations of what their business may sell for.

Having access to serious buyers is critical if a business broker is going to find the right buyer for a business. The good thing is Business Exits has relationships with a few thousand buyers and entrepreneurs who are serious about buying businesses.

For Buyers

Business Exits not only helps sellers find the right buyer for their business, they also help buyers find businesses that are a good fit for them. They do this through their unique framework which can help unlock the value of a business and maximize their investment.

Types Of Businesses Business Exits Sells

When looking for the right business broker, you need to make sure they serve the type of industry your business is in.

For example, if you want to sell a website or ecommerce business, you would typically use one of the best website brokers on the market. We suggest Website Properties to sell a web based business.

If you’re selling only a brick and mortar business that is mainly offline, you may use a traditional business broker such as Murphy Business Brokers.

Business Exits is a business broker that services both the online and offline world and they sell businesses in many different industries. This means you can use them if you have an online business or offline business.

Here is a list if the types of businesses that Business Exits sells:

- Agriculture

- Automotive and Boat

- Beauty and Personal Care

- Building and Construction

- Communication and Media

- Distribution and Logistics

- Ecommerce

- Education and Children

- Entertainment and Recreation

- Financial Services

- Food and Restaurants

- Fitness and Gyms

- Healthcare

- Manufacturing

- Marketing and Advertising

- Internet and Technology

- Pet Services

- Real Estate

- Retail

- Service Businesses

- Software

- Transportation

- Storage

- Travel

- Wholesale

So as you can see Business Exits buys and sells just about any type of company.

Business Exits Valuation Process

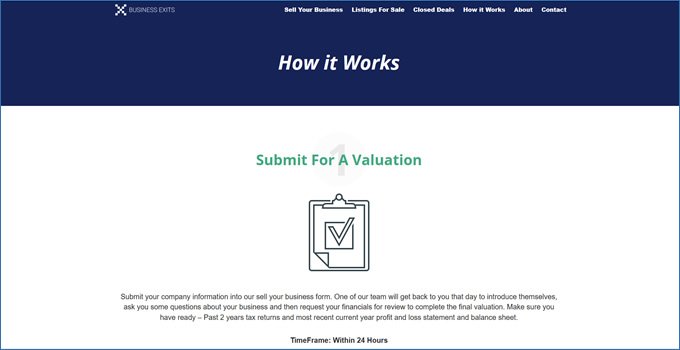

As with most business brokers, Business Exits offers a free valuation to help you determine the best price to ask for your business and to see if your business meets their requirements.

To start the valuation process, select the “Sell Your Business” link or the “Get A Valuation” button on their site.

Once you do that you are brought to a series of questions you need to answer.

The first question asks how soon you want to sell your business?

After you answer this question you are then asked what state you’re located in.

The next question asks you what type of business you’re in. You have 25 different types of business choices that you can choose from.

After this the next question asks you what was your gross revenue the last 12 months. You will have several choices which are shown below:

- Under $1.5 Million

- $1.5 Million to $4 Million

- $4 Million to $10 Million

- $10 Million to $20 Million

- $20 Million +

Then you will need to specify what your net profit was including your salary for the last 12 months. Your choices are:

- Under $300,000

- $300,001 – $600,000

- $600,001 – $1.5 Million

- $1.5 Million to $2 Million +

Next you will under the URL of your business website.

From here you will end the valuation request by giving the team at Business Exits your contact information.

Once the valuation request is submitted someone from Business Exits will contact you within 24 hours to get more information from you so they can complete the valuation. You will need two years of tax returns and a current balance sheet and profit and loss statement.

Business Exits Sales Process

Starting the business valuation was step number 1 in the whole sales process. Now we will look at the remaining steps to get your business sold with this business broker.

Step 2:

After the valuation request has been submitted, step 2 in the process to sell your business with Business Exits is to get a firm valuation. This requires a second call from one of their business brokers on staff. During this call they will go over the 13 factors they use to value a business and then give you a range of what your business can be sold for right now.

This process can take up to 48 hours.

Step 3:

Step 3 in the process to sell your business is getting the agency agreement which outlines the responsibilities of Business Exits and how they will act on your behalf. It will also outline how much tye will be paid and when they will be paid once the business sells. It is suggested that you take this document to your lawyer for review.

This part of the process takes 1 to 5 days.

Step 4:

After Step 3 is complete and the agreement has been signed, you then proceed to step 4 of the process. In this step Business Exits will gather more information about your company. They will use this information to build a prospectus which will allow buyers to see all the details about your business.

In this step you will need to provide up to five years of tax returns, payroll reports, balance sheet that is current, profit and loss statement, history of your business, any license or trademark information, and typical questions that will come up about your business.

This step can take between 2 to 10 days.

Step 5:

In the fifth step of the process you will get a one hour interview with one of their in-house copywriters. The copywriter will take the information you have given and what they have learned in the interview and create a compelling story and executive summary about your business that will make buyers want to learn more.

This step can take 1 to 4 days.

Step 6:

To help gain a wider audience of buyers, buyer financing is secured even before your business is released to the market. This is done so that you will get a full cash payout even if a buyer has less cash on hand than the price of your business.

This step can take up to 7 days to complete.

Step 7:

All of the information gathered by Business Exits is used to create a very detailed prospectus. This is a 15 to 30 page document that tells the complete story of your business including how it works, how it makes money, and all financials. Everything the buyer needs to help them decide if they may want to pursue the purchase of the business is included.

The timeframe for this step is within 7 days to complete the process.

Step 8:

In this step it’s finally time to take your business to the market and actually begin the process of looking for serious buyers.

The Business Exits team use three different marketing methods to look for buyers:

- The deal is sent out to their buyer database. Close to 70% of all deals find buyers at this initial step.

- 13 different marketing channels are used to get a wider audience of prospective buyers.

- A targeted list of synergistic buyers is created and then each is contacted directly. These can be suppliers, competitors, or distributors who may have an interest in your company.

When inquiries are received from potential buyers the team goes to work for you and tries to answer all questions on your behalf. If they can’t answer the buyer’s questions then they will get the answers from you and then get back to the buyer with the answers.

A call will also be set up with the buyers so they can discuss the business directly with you.

This step can take 1 to 4 months so don’t expect it to move quickly. Finding the right buyer can take time.

Step 9:

Once a buyer places an offer, you move into the next step of the process and that is looking over offers and choosing the best buyer for you.

The Business Exits staff will negotiate the final price with the buyer. Once an amount is agreed to you will enter the next phase where the winning buyer will have an exclusive due diligence period.

This step normally takes 7 to 14 days to complete.

Step 10:

At this point you have chosen the best offer and now the buyer has a chance to verify all of the information provided on your prospectus. They will verify all financials and anything else you claimed about your business.

This step normally takes 2 weeks to 8 weeks to complete depending on the complexity of the business.

Step 11:

Once the buyer is confident all of the information provided to them is accurate and they wish to proceed with the sale, they will develop what is called the contract for sale. It’s advised that you would get your attorney to review this contract and revisions will be made until a final contract is agreed upon.

This can take 2 weeks to 4 weeks.

Step 12:

After the contract is signed by both parties, it’s now time to have the buyer transfer fund for the purchase into Escrow. Escrow is a third party service that holds the funds until all of the conditions have been met to release the funds to the seller. You will transfer all assets to the buyer and once that is complete the funds will be released to you.

Time for this step in the process is typically 2 to 7 days.

Step 13:

Now that you as the seller have the funds and the buyer has all assets, it’s time for the transition period to begin. During this period you will teach the buyer everything they need to know to operate the business, and introduce them to any employees and suppliers.

The time period for the transition period is agreed to in the contract but normally lasts 1 month to 6 months.

It can take 4 months to 12 months for the entire process to be complete and to get your business sold and complete the post training process.

Business Exits Success Rates

It’s clear that Business Exits has sold quite a few businesses since they launched in 2013. While we do not know their exact sales figures we do know that they have 20 businesses for sale at the time we compiled this Business Exits review.

Jock Purtle’s LinkedIn page says they are planning to hit $100 million dollars in sales in 2020. That means they are selling quite a few businesses and most of the businesses they sell are valued at $1.5 million and above.

The closure rate for this broker is actually very good. They close 95% of their deals. Industry average is lower than this.

Fees Charged By Business Exits To Sell A Business

Most business brokers don’t charge any fees until they sell a business. The same holds true for Business Exits. They do not charge any upfront fees and only get paid once a business sells.

We are not sure of the exact success fees that are charged by this business broker. What we do know is that they have a sliding commission scale.

- For businesses that are under $2 million in valuation their typical fee is 10% of the sale.

- Businesses over $2 million in valuation come in at 5-6%.

- $10 million and above can be around 4.5%.

- The higher the valuation the lower the fees.

You will need to contact this brokerage to learn more about their fees.

Pros And Cons Of Using Business Exits

Now let’s take a quick look at the pros and cons of using Business Exits to sell a business or to buy a business.

Pros

- Valuation tool is easy to use and free

- Very thorough prospectus prepared helping to get buyers interested

- High success rates

- Smaller firm meaning more personal service

- No upfront costs

- Success fees are typical and not too high

- Great response times

- Sell businesses in many industries

Cons

- Very young company compared to much older firms

- Mainly deal with larger businesses valued at over $2 million

- Not as specialized as website brokers if looking to sell an online business

- Do not mention fees on website

- No phone number shown on website

Business Exits Review Conclusion And Verdict

Here we will summarize our findings for this review. Our goal is to help you make an informed decision about whether you should use this firm or not.

Upside

The upside to using Business Exits is the fact that they over a free valuation. We like how their process works and how easy it is to do. Their website is very user friendly and modern with a clean interface.

It seems that the prospectus that is prepared by their team is quite detailed. Some business brokers do not put this kind of effort into a prospectus so this was good to see. (Website Properties is another firm that creates a very detailed prospectus)

While some people like the service of larger business brokers such as Transworld Advisors or Sunbelt Business Brokers because of their vast reach, we like smaller firms like Business Exits. In our opinion the personal service you get from a smaller firm cannot be beat.

We contact every business broker that we review and Business Exits was no exception. We made initial contact and never received a response. We tried again and this time they responded to our request within 45 minutes which is a great response time. We wish they had a phone number on their website but we could not find a way to call this broker.

Besides these things we do like that this firm does not charge upfront fees and only gets commissions after a business sells.

Downside

On the downside, this is a younger business broker which means they do not have the experience of some business brokers who have been around for over 20 years or more.

If you have a smaller business valued at under $1 million, they may not be the business broker for you since they mainly deal with higher valued businesses.

We wish that fees were listed on their website but we had to contact them to try to get an idea about their fees. We still did not get a clear answer but we understood that they operate on a sliding fee scale based on the value of your business.

Overall Verdict

Overall, we think that Business Exits is a great business broker to buy or sell a business with. While not our first recommendation, we feel confident to recommend them to anyone who has a much larger business to sell.