When it comes to business sales in Arizona, there are many options, but perhaps none as easily accessible as Arizona Business Sales & Acquisitions. The company specializes in business-to-business transactions and covers a multitude of industries. We’ve rounded up everything you need to know about this business broker in our Arizona Business Sales & Acquisitions review below so you can determine whether it’s right for you!

UPDATED: April 2024

Our Overall Rating

Overview Of Arizona Business Sales & Acquisitions

Arizona Business Sales & Acquisitions is a business brokerage firm dedicated to focusing on more than just strict sales goals and quotas. Instead, they aim to incorporate those figures into the proper valuation. This is done by working with a limited number of businesses in order to ensure that they are providing high-quality customer service from the point of valuation to closing.

Arizona Business Sales & Acquisitions is located in Scottsdale, Arizona, and was established in 2000. They operate as a full-service business brokerage firm that specializes in the confidential sale and acquisition of private companies as well as commercial real estate. With over 20 years in service, the company has helped many businesses with buyer and seller representation. They claim to help both main street and lower M & A market businesses.

Over the years, the transaction values have totaled between $300,000 and $5 million. Though based in Scottsdale, the business does support businesses in multiple Arizona locations, including Phoenix and its metro area, Flagstaff, Sedona, Kingman, Prescott, and others.

Services include representation for selling a business or property, acquisition guidance, locating a proper franchise, and more. Industries covered are also far-reaching with experience in retail, wholesale, restaurant, manufacturing, service, business to business, and automotive.

Why Use Arizona Business Sales & Acquisitions?

The company has many reasons as to why a potential business owner should choose their services. First and foremost, they address the issue of whether to use a broker or do it themselves. To that, they say that opting for a broker like them ensures anonymity.

Opting for a broker also means someone who is knowledgeable in the business and can represent your best interests based on market averages, trends, and similar. Another major component is confidentiality. This speaks more to their unique policies but should hopefully be standard across the board.

In choosing to list with a company like Arizona Business Sales & Acquisitions, any information you share is protected and safe. This also means vetting buyers and prompting them to sign confidentiality agreements that protect all parties involved.

Types Of Businesses Arizona Business Sales & Acquisitions Sells

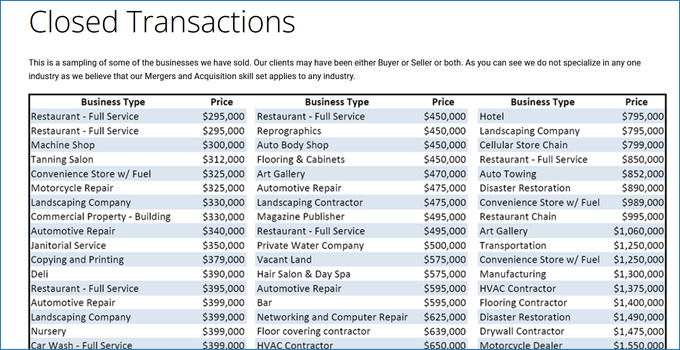

The businesses that are sold by this broker are not limited to a select niche. Arizona Business Sales & Acquisitions is familiar and comfortable with multiple industries, especially because of their excellent Mergers and Acquisition skills. On their website, there is a section for closed transactions where businesses that were bought or sold via their firm are listed. This is under their “done deals” category.

Past examples include:

- Tanning Salon – Price: $312,000

- Auto Body Shop – $450,000

- Bar – $595,000

- Hotel – $795,000

- Art Gallery – $1,060,000

- Nursery – $399,000

- Janitorial Service – $450,000

As you can see, there’s no one type that Arizona Business Sales & Acquisitions sells, which means more people have access to its services.

Arizona Business Sales & Acquisitions Valuation Process

The valuation process used by this business broker is industry standard, though the exact process may look unique for every business based on their attributions and issues. Arizona Business Sales & Acquisitions first approaches the question of what a business is worth from the perspective that people are curious about their business’ price, not the actual value.

This is because when most business owners ask that question, they want an easy-to-understand price tag slapped on their business rather than the actual, multi-faceted answer. As such, their team works to make sure that during the valuation process, they take time to help you understand all aspects of your business’ worth.

So, the valuation process for Arizona Business Sales & Acquisitions first begins with the question of why you want to know the value of your business. The answer you or any other business supplies will determine how the company approaches the project.

There are different pathways to finding the value and definitions of it, such as standards of value, which are based on the underlying purpose. You might be curious about the value because you’re dividing assets among a divorce, buying a business partner out, or simply growing capital. The possibilities are endless, and depending on your unique situation, they will approach the valuation process uniquely.

Fair Market Value

If you are selling your business for a non-adversarial reason, you might expect a Fair Market Value assignment from this firm. This breaks down to the price point at which the business can be sold and bought without any compulsion to do so on either end. With each party having access to facts relevant to the business and there was no desperation to make a sale, what would the business sell for?

This figure is what the Arizona Business Sales & Acquisitions team will help you to find. It’s based on many aspects, and the company describes it as a science and art. Incorporated into the valuation process are asset values, industry trends, risks, lease or property conditions, financial performance, revenue concentration, local marketplace trends, strengths, weaknesses, potential, and more.

The value of your property is very important for investors, lenders, and other parties involved to understand. Luckily, this brokerage works to calculate all relevant information, making your final asking price or otherwise value justifiable. The company also helps on the buying side. You can request that they value a property you’re considering buying in order to ensure you have a good deal.

Sales Process for Sellers

The goal of Arizona Business Sales & Acquisitions is to make the selling process as painless as possible from start to finish. The process begins with making sure that you, the business owner, are comfortable with their team. Since business transactions can be complicated and include many moving parts, it’s important that all parties work well together.

From the point of verifying that all parties are comfortable together, this firm will prompt you to sign a confidentiality agreement. The agreement will state that they acknowledge your right to privacy and will do everything in their power to honor it. This includes limiting their team from disclosing any unauthorized information to third parties.

From there, it’s time for the valuation process. This step can take a little bit of time, especially because they require a ton of documents to get started. Documents are not limited to financial ones but also include other documents, such as ones on building specs. The valuation step takes roughly one week, and from there, the firm’s team will prompt you to take some time and make a decision on whether to move forward.

If you choose to move forward with a deal, you will be prompted to sign representation agreements that protect you and the Arizona Business Sales & Acquisitions team. Then the fun begins! The broker’s team will promptly begin marketing your business in what they like to call a “blind” marketing process. This is an effort to weed out only those buyers who are qualified. The blind listing won’t include specifics like the business name and address instead of focusing on unidentifiable key measurements, like sales volume.

If a buyer is interested in your business, they must sign an NDA and complete their profile before they can move forward to the next step of introductions and potential negotiations. Buyers must supply details like cash on hand, net worth, their time frame, and similar. All of these details help to determine if their needs are a good fit for what you can offer.

The next steps include meetings for introductions, all of which are facilitated by the Arizona Business Sales & Acquisitions team. From there, the selected buyer will make their decision, and if they choose to move forward with the deal, a purchase agreement will be drawn up and executed. This business broker doesn’t leave your side during the transaction until all is said and done, even if that means communicating with leasing and utility companies to help iron out details.

Once all papers have been signed, and all parties are taken care of, you can celebrate – your business has officially been sold!

Vetting Process for Buyers

From the time you approach Arizona Business Sales & Acquisitions with interest in selling to the time that your business is actually sold, there is a lot of work that goes into getting to know your business. This process, as performed by their brokerage, helps to protect all parties involved, ensuring that a “lemon” business isn’t being sold or bought.

A bulk of this vetting is done upon first interactions with business owners. After the intent is decided, their brokerage team usually dives right into valuing the property, which means looking at financial records, building history, and the local market space. All of these are funneled into a report that any buyer will have access to so that they can make a well-informed decision.

Arizona Business Sales & Acquisitions Success Rates

Unfortunately, there are currently no statistics listed on the company’s website indicating their success rates. This means business owners do not have any clear measures of success to consider prior to reaching out, including what percentage of the businesses listed are sold.

What we do have access to is the dollar amounts for which businesses are selling at Arizona Business Sales & Acquisitions. On the low end, a few businesses are sold for $300,000, but the company does have a hefty list of million-dollar transactions that they facilitated. One of the highest-priced businesses is in the manufacturing sector, and it sold for $3,800,000. It seems most fall within a middle ground of $600,000-$1,000,0000.

Fees Charged By Arizona Business Sales & Acquisitions To Sell A Business

Arizona Business Sales & Acquisitions is a business that does not offer its fee structure on its website for all to consider. Instead, you will need to contact the company for more information, especially because they base the actual rate on your business properties.

Their fee structure is called the Flexible Fee structure. It is their title for their commission, which they collect on every sale. The fee is not taken prior to closing and is also known as a success fee. The fee is due upon a successful transaction, and they require the fee upon that point.

The company claims that their fee structure is unique and that they are the only broker firm offering such a flexible option for fees. Sellers are able to lower their fee amount, and they may opt for a standard fee. This is only applicable for actual transactions, and the advisory services at this brokerage are measured on a different fee scale.

For advisory services, you can expect to pay a retainer fee, which the company self-describes as “reasonable,” that is to be paid upon successful finishing of a representation agreement. From there, you’ll be responsible for final payment if the closing does happen.

Pros And Cons Of Using Arizona Business Sales & Acquisitions

Pros

Lengthy Vetting Process

In order to prepare for a sale, the Arizona Business Sales & Acquisitions team takes their time getting to know all parties involved. For business owners, this means handing over all relevant data, even some you might not have thought of as useful. And for sellers, this means filling out a profile with your businessman stats and signing confidentiality agreements.

Local Arizona Option

While national business brokerages can be a great option, they sometimes are generalized and impersonal. With this firm, you know that as an Arizona business owner, you’re receiving localized care and potentially great local market insight.

Hefty Track Record

According to the website, the company has done quite a few deals since being established in 2000. Based on the closed interactions section on the website alone, the average seems to be 3-4 per year in the hundreds of thousands to the multi-million-dollar range. If this list of transactions is only a snapshot, then the rate of annual transactions may be higher.

Cons

No Access to Closing Stats

Without clear information on closing statistics and overall success rates from a business, we have no idea what is working and if a business is failing behind the scenes. In this case, it’s troubling not to know the rate of businesses that are listed and remain unsold. That figure can be very telling of a business strategy and commitment.

No Access to Fee Information

Businesses that don’t list their fee information publicly have no obligation to keep things equitable. Depending on the unique situation, they can change their base fee as they see fit. Interested parties will need to reach out to see what the actual cut for the company will be, but when you’re shopping around for a broker, that process can be tedious.

Poor Response Times

We tried to contact this business broker to gather more information on the company and to check response times. We never received a response so this is not typically a good sign.

Limited Reviews

Evident in the section below is that there are no reviews for this company across the web. It is also unusual that even on the company’s website itself, there are no testimonials to learn from. Without reviews, we have no idea what claims are true and how this business operates.

Conclusion And Verdict

When it comes to understanding a business, it’s important to look at reviews from past clients. This process provides insight that is usually unbiased and can speak to the true experience of buying or selling with this business broker. To round out this Arizona Business Sales & Acquisitions review, we’ll look at a few sources to get an idea.

Formally known as Arizona Business Sales & Acquisitions and Acquisitions, this business does not have any reviews on Yelp. The company also does not have Better Business Bureau accreditation, which is one of the best signifiers for proper business operations.

The company does not have any complaints or reviews on its BBB page. However, the Better Business Bureau has flagged their business page for falsely using the BBB logo for their site. The logo and BBB name are only legal when the accreditation has actually been received, yet Arizona Business Sales & Acquisitions uses it as if it has the rights. BBB states that they are in violation of trademark laws and repeatedly ignore a request to cease use.

The business’ own website does not list any testimonials, so there is also no way to gain insight into services that way, even if biased. With few reviews across the web about this business brokerage, it’s unclear if all of the claims and processes lined out by the company themselves are true. Arizona Business Sales & Acquisitions reviews are an important part of understanding the business, but they are extremely limited here.

Final Verdict

If you’re an Arizona business owner looking to sell, or a hopeful buyer, we recommend researching broker alternatives, or at the very least, proceeding with caution here. We are not saying that this business broker provides bad services, not at all. There is simply not enough information across the web, specifically third-party sources, to back up the claims made by the company.

There are plenty of alternative business brokerages available on a national and local level (see our Website Properties review) that have social proof as a safety net (see our top business brokers comparison and our list of every business broker in the United States). Also concerning is the company’s flag on their Better Business Bureau page for repeatedly claiming BBB accreditation by using the BBB logo and name without permission. As our only true third-party piece of information, this does not look great for this company.