Buying and selling online businesses has become a popular way for entrepreneurs to enter or exit the market. Acquire (formerly MicroAcquire) and Flippa are two marketplaces that connect buyers and sellers to conduct their own deals independently.

Both Acquire and Flippa have key advantages and disadvantages that buyers and sellers should be aware of. In this article, we will delve into the fees, features, and other factors that set these platforms apart, so you can determine which one best suits your needs.

What is Acquire [Formerly MicroAcquire]?

Acquire (formerly known as MicroAcquire) is an online marketplace for startups and online businesses. Founded in 2020 by Andrew Gazdecki, the goal of Acquire is to make acquiring and exiting businesses as simple as possible.

Acquire has a simple, powerful platform that connects buyers to startup founders wanting to sell their businesses. The marketplace hosts thousands of listings and hosts in platform tools to help close deals in as little as 30 days.

Since its inception, Aquire has built an audience of 200,000 founders and buyers. They’ve closed $500M in acquisitions and have raised $6.5M in funding after raising $3.5 million in July 2021.

Unlike a typical brokerage or marketplace, Acquire has a subscription model for interested buyers. Premium membership costs $390 yearly and gives buyers access to new listings. There are no listing fees for sellers to list on Acquire, however, sellers do have to pay a 4% closing cost on deals. This is a reasonably low commission to pay on a deal compared to the wider industry standard so it makes sense that Acquire has been a growing preferred platform for sellers and buyers alike.

Benefits of Acquire [Formerly MicroAcquire]

Strong Buyer Network and Networking Opportunities

Acquire’s established network of 200k entrepreneurs means there is a large active buyer pool for online business assets, perfect for securing a buyer and closing a deal in as little as 30 days.

Beyond closing deals, there are many well-established entrepreneurs active in the community, so networking on this particular platform can lead to great opportunities and new connections.

No Listing Fees and Low Seller Commissions

Since listing on Acquire is free for sellers and sellers only pay a 4% percentage of their purchase price due at closing, there is a low-risk, high-reward incentive for online business owners looking to seller their business. A 4% commission rate is much lower than other brokerages so sellers get to keep more of the proceeds from the sale; one of the strongest “pros” for Acquire as a marketplace.

Independent Deal Process for Buyers and Sellers

Those who want to do deals on their own will love the in-platform framework for deals that Acquire provides. Everything is laid out to empower buyers and sellers to do deals independently while still keeping an organized, legal, and fair structure in place.

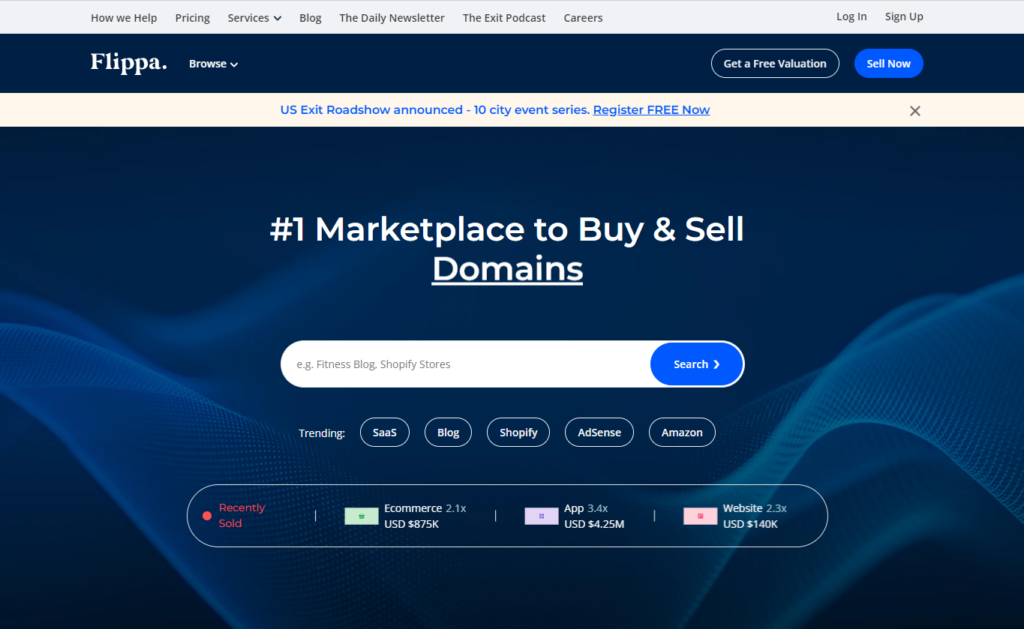

What is Flippa?

Founded in 2009, Flippa is considered to be the oldest platform for buying and selling online businesses. Since its inception, Flippa has sold over 300,000 assets and has built an audience of three million.

With over 6,000 listings currently available on the marketplace, they have the largest selection of online businesses for sale in the industry. From just a couple hundred dollars up to over $10M, Flippa offers acquisition opportunities to newbies and experienced private equity buyers alike.

Flippa is an open platform for buying and selling online businesses, meaning listings typically aren’t vetted prior to being listed on the marketplace and most deals are facilitated between buyers and sellers.

That being said, Flippa is growing and changing rapidly. They now offer paid services for M&A advisory and due diligence support and are creating more in-platform teams to make buying or selling your business a stress-free experience.

Read the detailed Flippa review if you’d like to learn more about this popular marketplace.

Benefits of Flippa

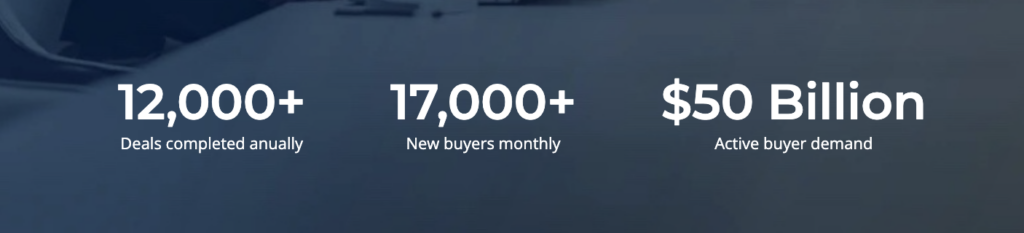

Large Buyer Pool and Audience Reach

Flippa claims to add more than 17,000 new buyers to their audience every month. They already boast an audience base of millions and an email list of +360,000 ready to be marketed to. This is important for sellers who want a high degree of exposure for their listing to a wide audience of interested, engaged buyers.

Wide Range of Businesses Listed for Sale

Almost every online business model and niche can be found on Flippa. Whether you’re interested in e-commerce, content sites, mobile apps, or service businesses, you’ll find a wide selection of listings on Flippa that are likely to hit your buying criteria. As long as you’re an experienced acquirer who knows how to spot a trustworthy, solid business, Flippa’s marketplace is great for finding hidden gems that may not exist on other platforms.

Customizable Deal Process

The baseline deal process on Flippa is to place all parts of the deal, from listing to migrating a business on the shoulders of the buyer and seller. But that is now changing.

Flippa offers a range of services depending on deal size that allows buyers and sellers to tap into support should they need it. Want help with the due diligence process? Flippa now offers three tiers of due diligence reporting. Need a skilled advisor to help with negotiations? If your deal is worth more than $250k, Flippa automatically assigns you an M&A advisor.

Of course, if you want to be completely independent, you can do that as well while utilizing the abundance of content Flippa has created to support buyers and sellers throughout the deal.

Flippa vs Acquire: How do they compare?

Types Of Businesses Offered

Acquire

Acquire (Microaquire) often uses the word “startup” to describe their listings, but that term also encompasses strong online business monetizations like e-commerce, agencies, and SaaS.

SaaS in particular has been a strength of Microacquire, as they’ve become a leader in buying and selling SaaS assets in the industry.

The marketplace allows you to filter what type of asset you want to buy, making it easier to find the one that matches your buying criteria. There is a wide range of niches, with startups and online businesses in niches ranging from SEO to books.

Flippa

With over 6.000 listings currently on Flippa’s marketplace, there’s a business for the pickiest buyers. The majority of assets available to buy on Flippa are websites ranging from affiliate sites, e-Commerce sites, and Amazon FBA sites.

For buyers looking for a specific niche, they are likely to stumble across a listing on Flippa. This is perfect for buyers with a tight list of buying criteria as it’s possible to filter listings on Flippa’s platform.

Outside of popular online business monetizations, you can also buy mobile apps and domains, making Flippa a one-stop shop for online business buyers.

Business Valuation Process

Acquire

Once you set up your account with Acquire you can start the process of listing your business for sale. You’ll submit your business metrics and documents to be verified.

In the process of setting up the listings, sellers will be able to set their own valuation for their business.

Acquire provides overviews on how to value an online business and assures sellers they will give a review of the asking price to ensure it is reasonable. According to their own marketplace data, here are the multiples they suggest based on monetization:

- SaaS: 2-5x revenue or 4-7x profit

- Ecommerce: 1-2x revenue or 3-5x profit

- Marketplace: 1-3x revenue

- Agency: 1x revenue or 2-3x profit

Once the listing is set live sellers will be able to negotiate directly with interested buyers about the list price.

Flippa

To get a sample valuation with Flippa, you can start by using their free valuation tool. By submitting information about your website such as the URL, organic traffic data, and when the business was started the tool then automatically generates an estimated business value.

Your website must be at least 12 months old to use the valuation tool as websites under a year old aren’t established enough to get a reliable estimate.

Upon submitting your listing for sale, Flippa will create a more extensive valuation based on data such as monthly income, expenses, and any other relevant information. The details and final valuation will go on the listing page for buyers to see.

Listing Information

Acquire

The URL of a business is hidden on the listing page and more details about the business are kept private unless a seller specifically gives a buyer access to that information. Sellers are able to approve or deny information requests so they can choose who can view the URL and website analytics.

Of course, interested buyers will need some deeper information than what’s on the listing page, in which case Acquire suggests having Non-Disclosure Agreements (NDA) and non-compete contracts signed to ensure the listed business is protected from copycats.

Flippa

When it comes to using Flippa, as a seller you have the option to make your listing public (with the domain name visible) or private.

Public listings reveal the domain name along with detailing the basic listing information such as selling price, monetization method, site age, and what type of business it is.

Sellers have the opportunity to make the listing private however this comes with an extra add-on fee of $199 paired with the listing fee. In order to see the URL of a private listing with this add-on, any potential buyers are required to sign an NDA to ensure the privacy of the business’s information.

Commission and Listing Fees

Acquire

Acquire does not charge a listing fee to list on their platform. They have, however, went from having zero commission to adding a sale commission of 4% to sellers upon closing their deal. This commission is a flat rate and one of the lowest broker commissions in the industry.

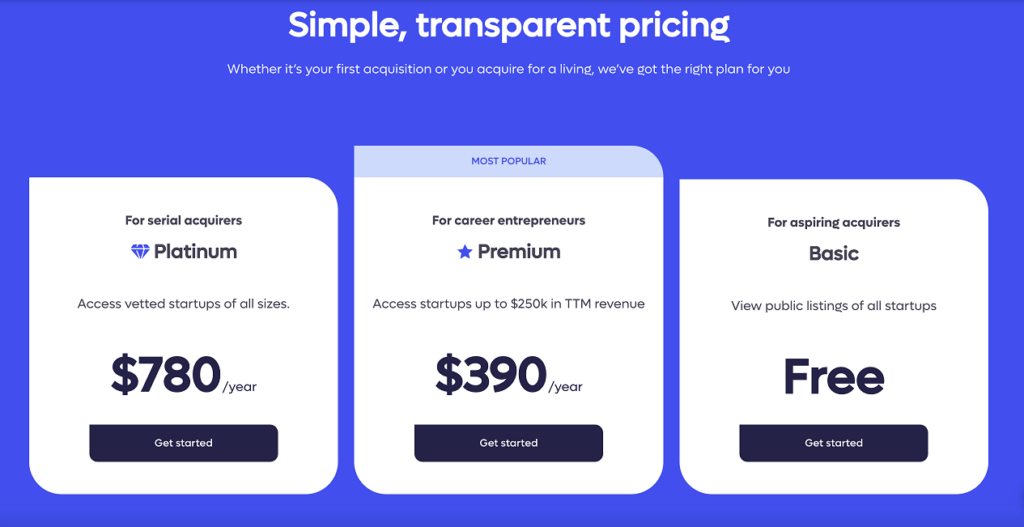

For buyers, they join Acquire’s platforms as members under a free or paid subscription plan.

Acquire offers a free membership for aspiring acquirers to view listings. As a basic user you are able to access the public details of all listed startups and filter listings based on your criteria.

Premium membership is reserved for prospective buyers, as this tier gives access to Acquire’s guided workflow and legal document templates.

Premium buyers can only view listings up to $250K in TTM revenue, so for buyers looking for larger acquisition opportunities the platinum membership of $780 per year would be the ideal annual subscription service.

Flippa

Flippa does charge a fee to list your asset on their marketplace. They have a flat rate of at least $39 to list on their marketplace but for more services, Flippa charges a tiered pricing structure.

If your website price is listed for $1-$9999 then you will have access to two different listing packages, standard or enhanced. No matter the package you choose, you’ll still have to pay a 10% success fee (a portion of your listing price that will be due to Flippa upon completion of the sale).

If your website’s listing price is higher than $10,000 then you’ll have access to their premium, standard, and ultimate listing plans.

If your business is bought on Flippa you’ll have to pay a commission fee to Flippa based on the final sale price.

Flippa’s sale commission is as follows :

- $1-$49,999 = commission will be 10% of the sale price.

- $50,000-$99,999 = commission will be 8% of the sale price.

- $ 100,000-$249,000 = commission will be 6% of the sale price.

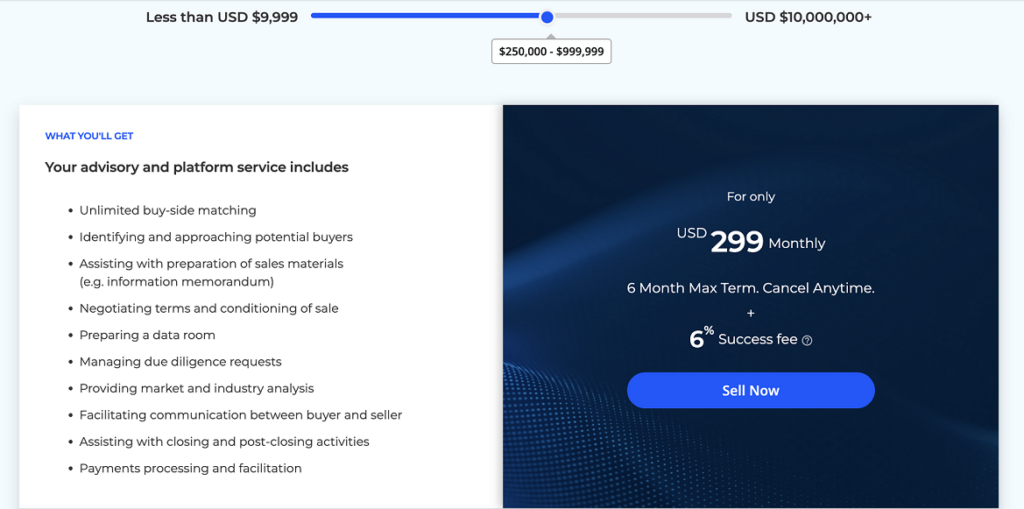

For assets priced over $250,000, sellers will have a certified M&A Advisor who will personally manage the sale process. Below are the terms of the package and what sellers can expect to get from Flippa’s M&A service:

All businesses above $250K qualify for Flippa’s M&A program. However, there is good news for sellers: as the list price increases, Flippa’s sale commission decreases. Here is how the commission above $250K breaks down:

- $250,000 – $999,999 = commission will be 6% of the sale price.

- $1,000,000 – $4,999,999 = commission will be 5% of the sale price.

- $5,000,000 – $9,999,999 = commission will be 4% of the sale price.

- $10,000,000 and above = commission will be 3% of the sale price.

Businesses priced below $999,999 will pay $299 monthly to list their business with Flippa for a maximum six-month term. Any business listed above $1,000,000 will have to pay $499 monthly to Flippa to list their business and be a part of the M&A program.

Vetting and Due Diligence

Acquire

On a very high level it seems as though listings are vetted for the Acquire marketplace, but a majority of the vetting and due diligence works falls on the buyer to conduct when looking for a deal.

Flippa

Flippa doesn’t have a built-in vetting process to list on their marketplace. Anyone is able to list on the marketplace and due diligence falls on the buyer to conduct on listings of interest.

They do provide some content surrounding due diligence best practices for buyers. Flippa’s due diligence checklist suggests verifying a few of the following metrics before buying a site:

- Business model

- Whois history

- Get to know the seller

- Plagiarism check

- Monetization

- Revenue account transferability

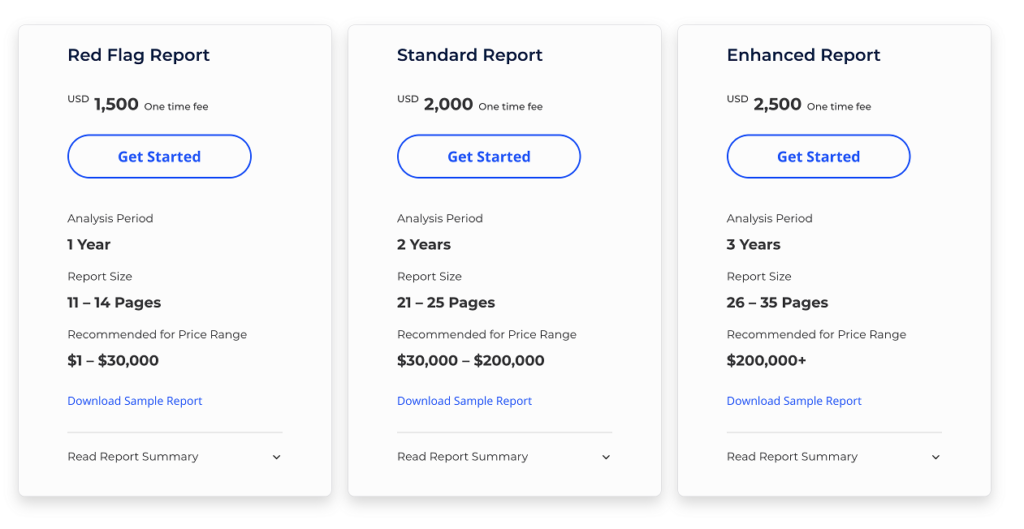

Flippa now offers an in-platform paid due diligence service for those wanting more support during the buying process. They offer three levels of service for due diligence with different levels of support.

Here are Flippa’s three different pricing plans for their due diligence services:

Deal Process Support

Acquire

Acquire has over 100 specialist advisors with expertise in due diligence, legal compliance, and tax information that are on hand to help advise sellers should they have questions in the deal process. Their customer success team is on hand when needed, but generally the deal is run by the seller and buyer.

Flippa

Flippa deals tend to be run by the buyer and seller themselves. However, Flippa is starting to add more in-platform service to help with the deal process.

Flippa now offers a “Managed by Flippa” option for listings above $250k. For this service an assigned M&A broker supports negotiations between buyer and seller and offers support throughout the deal process.

Under Flippa’s services menu you can find additional services at varying price points for due diligence, legal document templates and even financing partners.

Marketing Businesses for Sale

Acquire

Acquire helps sellers with optimizing their listing so their page copy and presentation are as strong as possible. From there, listings are promoted via ad and email campaigns to a list of over 200,000 members of the Acquire community.

Flippa

Flippa has an audience of millions, so simply listing the business on their marketplace should give valuable buyer exposure.

Unlike other brokerages, Flippa has additional pricing for marketing listings. Flippa breaks these marketing services down by sales price as follows:

- Under $50k: Getting boosted search results or featured on the home page with Flippa’s Ultimate or Premium packages will cost an additional $399 – $499.

- Businesses between $50k – $249k: Ultimate and Premium packages cost increases to $499 – $599

Above that threshold the “Managed by Flippa” option comes into play and marketing would be built in to the monthly costs and sales commission.

Migrations

Acquire

Acquire connects buyers and sellers to Escrow within their platform-hosted deal process. Beyond that it’s on buyers and sellers to handle the migration of the business directly. That means the seller should understand how to transfer accounts, links, and important data to the buyer without impacting the functionality of the business.

Flippa

Flippa does not handle the asset migration process so the responsibility of migrating the business is on the seller and buyer to figure out.

Post Sale Support

Acquire

There is no post-sale support built-in on Acquire’s platform. If a seller or buyer would like support post-sale, they will need to organize those terms within their deal contract.

Flippa

Flippa also does not offer post-sale support after the deal is done. Since buyers and sellers are conducting the deal themselves, that is an element they can negotiate.

Acquire [MicroAcquire] vs Flippa – Verdict

All in all, both Acquire (MicroAcquire) and Flippa offer useful services and resources for buyers and sellers looking to purchase or sell a business independently.

When deciding which platform to use, buyers and sellers should consider their budget, the size of the business they are selling or buying, as well as any post-sale support they may need. With that criterion in mind, they may decide that the scale of the deal would be better suited for one marketplace over another.

For those selling a SaaS business, Acquire leads the way for selling SaaS businesses. Their community of SaaS founders and process of closing SaaS deals make them the ideal place to sell a SaaS business.

Generally, the quality of assets sold with Acquire is regarded as more vetted and higher quality than on Flippa, so sellers and buyers wanting a “trustworthy” factor would be better suited to do deals with Acquire.

That being said, Flippa is still a great option for those wanting to find hidden gem deals or wanting to market to one of the largest buyer audiences in the industry. It all depends on what your exit goals might be.

If you’re looking for advice on how to exit your business for the most money possible, you can source expert M&A advisory from Acquiring Digital to discuss your deal questions. On the buy side, Acquiring Digital offers buyers insight on where to find deals that match their buying criteria as well as insight on negotiating the best possible deal structure.