There are many benefits to using Digital Exits in order to sell an online business. When trying to manage a transaction that can take anywhere from 2 days to 6 months, it can be overwhelming.

Digital Exits is able to help. They provide resources, advisory and two different proven methods of connecting buyers with business to tremendous effect.

Digital Exits offers a traditional brokerage deal. They also offer an exclusive exit planning strategy where they work long-term with a business to prepare for sale.

The fact that they allow sellers access to an already-assembled list of buyers that they’ve created is very helpful. This means reaching more buyers easily, and assurance that they already have assets and are ready to buy. This new increase in audience means more offers, which in turn means a better sale price.

Digital Exits can help ensure the business is valued properly. Otherwise, sellers could miss out on profit. Whether due to misleading offers, or ignorance of the true value of their company, this isn’t right.

Their team helps fully prepare the business for sale in all aspects.

UPDATED: April 2024

Our Overall Rating

Overview Of Digital Exits

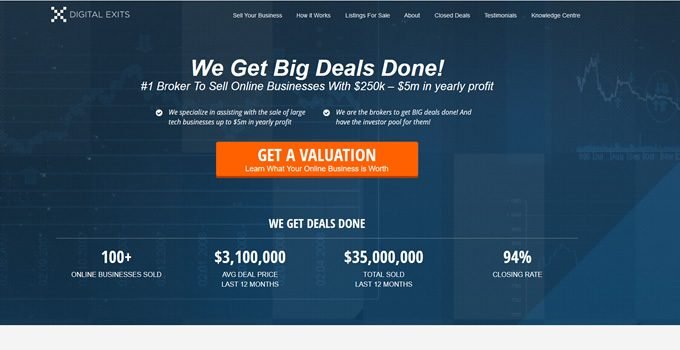

Digital Exits is a broker that specializes in the sale of online businesses. They work with businesses that make profits upward of $250,000 a year, up to $5 million.

This means that much of their clientele is made up by large technology oriented businesses. Because of their established presence in the industry, Digital Exits has a unique and varied portfolio of buyers.

Digital Exits is currently run by Jock Purtle and Robert Kale. Both have thorough experience and success in the field of buying, selling, and growing businesses. Kale began, grew and sold a business he started at 25, which is certainly no small feat.

Robert Kale’s own business endeavors have been affiliated with such top brand names as Costco and Nordstrom. The LA-based professional now helps other companies find their success via Digital Exits.

This acclaimed broker firm has been in business since its inception in 2014. Digital Exits reviews online suggest that the analytical and consultative approach its employees use works quickly and efficiently.

Types Of Businesses Digital Exits Sells

As its name suggests, Digital Exits works primarily with digital businesses. Specifically, large tech businesses that make at least $5 million in yearly profits.

Digital Exits works with all types of online business looking to sell, from retailers to manufacturers and everything in between. Many of these companies were able to sell for millions of dollars.

Testimonials explain that no matter the size of the deal, Digital Exits will work tirelessly. They look for high quality businesses that have improvement and upward trends at heart.

Looking to sell an online business? If it meets their criteria, the chance is good that Digital Exits can not only succeed, but net the highest profits. Their high percentage of businesses sold and understanding of the market means that they are uniquely qualified to advise in this niche

A large demand and poor supply of quality online businesses leads to increased prices, which, while unfortunate is good for sales’ profits.

As more people use the internet and become aware of online business, the larger that demand grows. Because of this, profit margins also continue to grow.

With an online business there are also no extra costs to consider like a physical business, such as utilities.

There are a few different types of buyers who may be looking to purchase an online business. First time buyers who may be looking to purchase a business because they’re looking to invest their pooled funds. They will often pay 2-3x earnings.

Financial buyers who focus on highest profit and return on their investment. Often experienced in the process, and looking for investments, these investors will likely pay a smaller multiple when buying. Often closer to 1.5-3x.

Strategic buyers, who are often companies, suppliers, with similar customers or other interests that share similarities or other opportunities. Focused on finding synergistic businesses to partner with long-term, these buyers will generally pay 2.5-5x earnings, but can be rare to find.

Lastly, Investor pools or retail investors, usually a person managing a private fund on behalf of a family, or a public fund. These larger investors will generally pay 2-4x the earnings.

No matter what type of buyer is right for a business, Digital Exits has a way to find and inform them of your listing. Their comprehensive database of buyers, attending speaking engagements like conferences and seminars, mail out lists, word of mouth, and advertisements all attracts perfect buyers.

There are several other ways they can help a business owner increase the profits when selling.

Selling when business is growing means that investors will see the upward growth trend and profitability, and therefore pay a higher price. Since they can see the improvement, they know it isn’t a big risk going forward.

Diversifying income and traffic sources means backing up for both sources. If a business is reliant on just one income or traffic source, losing either can be disastrous.

Documenting systems and processes is another strategy that Digital Exits is ready to help with. Creating an operating manual for the buyer which explains how to do everything they might need to know about the business.

Digital Exits Valuation Process

Digital Exits valuation process begins with the arguably most simple step: An interested seller submits the valuation request form to them. As a part of this, they will need proof of at least their last 2 years’ worth of tax returns. They will also need to submit information about the businesses’ profits and losses, as well as their balance sheet.

Next, the seller will be contacted by a member of Digital Exits team. This should happen within about 24 hours. During this call, they might need to clarify or request additional information about the finances, site traffic, or other details of the business.

Lastly, after reviewing, they provide a valuation to the business owner, and what they think they can sell it for. There are several factors that help a broker decide the most accurate and current value of a business.

While the most important of these is net profit, things like the growth trends, and site traffic are also taken into consideration. Other important aspects include the business model, niche, and age of the business. In tandem, the competition in that industry or niche affects the business value too.

Online businesses that have partnered with Digital Exits have made profits, ranging from hundreds of thousands, up to millions. So, how exactly does the broker accomplish this? Read on to find out more about their sales process.

There are two methods by which Digital Exits can help a business owner sell their company: straight brokerage, or their special program.

Straight brokerage simply means that they engage the seller, then find a buyer.

Their exit planning program consists of a 6, or 12, month program in which they consult, assist and prepare the business for sale. Their end goal is to obtain the highest sale price. Some methods to accomplish this includes improving the businesses’ profits, extracting the owner, and approaching strategic buyers on their behalf.

Some ways they can help a business improve its profits are looking at their costs, profit loss, and marketing. Digital Exits tries to view this information objectively to find even the smallest tweaks that could help maximize profits.

Extracting the owner means modifying the business to function with less reliance on the owner. This entails working with the owner to develop a manual to pass on to the buyer. A business that doesn’t rely heavily on the owner looks like a good investment to a prospective buyer, not another job.

When Digital Exits approaches a buyer, they look out for buyers with interests and goals in common with the client. This leads to more buyers who can see the potential profit in the future a business can make them and not just the current value.

Sales Process

Digital Exits’ sales process begins after the valuation. During the value call, the agent will explain the services and fees for the sales process.

After this they will provide the seller with the agency agreement.

This is a document that outlines the role of the broker within the agreement. It also dictates the amount of responsibility that the broker is able to have on behalf of the seller.

The agency agreement also lays out when and how payment will be made to the seller upon the completion of the agreement. Sellers may then take this document to their lawyer before signing.

Over the next few days, Digital Exits obtain any information they’ll need to build the prospectus. Their systemic process of compiling all the information, to then create the prospectus means a highly valuable report for the business going forward.

After signing the agreement, additional information, like further tax returns, payroll records, or licensing and trademark materials, may be needed.

Next, the seller will participate in an interview with Digital Exit’s copywriters. This will allow them to build a story, and executive summary, that attract buyers. This summary is designed to show the business in the best possible way and answer any frequently asked questions.

Bank financing then takes place. Digital Exits coordinates the financing prior to placing the business on the market.

This has the benefit of allowing a wider market to potentially purchase the business since they can obtain a loan. This also means that the full amount is made at closing.

At this point, Digital Exits will place the listing on the market. This means that it goes out to their database and marketing channels. They will also contact buyers with a known presence directly if their needs align closely to the business for sale.

Once offers are accepted, the price, and other terms of the offer will be decided on and negotiated. This is when the Letter of Intent is drafted. The selected offer then goes on to the due diligence stage and is able to verify the business’ information.

After due diligence has taken place, the buyer sends the seller their contract, to be reviewed with an attorney. This often takes the form of an asset purchase agreement that explains the sales price or other stipulations.

A third-party escrow service like a lawyer, or an escrow company, holds the funds while the buyer transfers their funds. The seller then transfers their assets, and once the buyer receives confirmation, the payment is released, and Digital Exits’ fee is also paid.

Finally, the post-sales training, in order to teach the new owner how to run the business, takes place. This is a transitional period that helps the buyer learn about their new acquisition, and introduce new training, or other resources. This is usually negotiated ahead of time during the contract negotiation.

Why Digital Exits? If a business owner is looking to sell their online business, Digital Exit’s track record is sure to be a solid testimony to their ability.

Digital Exits Success Rates

This firm has worked with over 100 online businesses world-wide.

On average, these deals sell for $3.1 million. The total sale value of businesses that Digital Exits has closed transactions with is $35 million.

The highest price received for sale by this broker was a business which was listed at $8.5 million. These numbers may speak for themselves, but Digital Exits closure rate of 94% speaks even louder.

As a leading resource on online business appraisal, they are happy to report that their business value report is among the most widely known and utilized available.

Fees Charged By Digital Exits To Sell A Business

Digital Exits’ fees are paid via a percentage of the total sales price after the deal has been successfully closed. They don’t charge an upfront fee.

Pros And Cons Of Using Digital Exits

Digital Exits will handle buyer inquiries to the fullest extent of their ability. If they aren’t able to answer a question, they’ll redirect potential customers’ questions to the seller. They also can set up management calls to discuss details when a buyer requests more information about the business.

Digital Exits is a company founded on the concept of online entrepreneurs creating a broker built for online entrepreneurs. This compounded experience and depth creates a valuable community.

Their specialized system is designed to help business owners unlock and foster the hidden potential within their companies, while simultaneously finding the right buyers for them.

This process means that their list of premium buyers is always active and growing. Their goal is to procure multiple buyers for each business, thereby creating the perfect environment to encourage the perfect buyer.

Multiple buyers creates demand in the form of tension between the buyers. This allows sellers to control the situation. Through this they can find the buyer who is most able to recognize, appreciate, and compete for, the sale by paying the highest price.

Currently, this lucrative pool of buyers has the purchasing power to be able to buy over $600 million in assets.

Digital Exits focuses on the aspects of managing the sale so that the business owner can easily continue running and growing their business in the meantime. They manage the deal flow, buyer questions, and of course, keeping track of the buyers, and other details throughout the transaction.

Since a broker sells businesses full time, they’ll often have info or insights a seller may not. Digital Exits also helps ensure the information of all parties is kept safe and confidential during the sales process.

The one thing we did not like about Digital Exits was their response times. We contacted them and never received a response to our request. This is not a good sign.

Conclusion And Verdict

Digital Exits reviews suggest that the methods they use are paramount to their success as an online business broker. Their experience helps companies position themselves perfectly to the right buyer in order to get the best profit they can.

Testimonials from these clients laud the firm’s ability to streamline the process. They also praise the quick and easy experience Digital Exits offers, when the process is usually expected to be a headache.

A unifying accolade throughout these statements is how hard Digital Exits works. They strive to find and connect the absolute best buyer to each business they work with.

Digital Exits seems to be a growing business broker. They also seem to have very good closure rates. The one thing we found about this business broker that we did not like is they do not have good response times. In fact, in our attempts to contact this broker, they never responded to our requests.