After years of hard work, your online business has finally reached the point where you’re profitable and feel that it’s a good time to cash out. In order to cash out though, you’ll have to secure a strong valuation for the worth of your business.

We’ve put together a comprehensive guide to help you understand what to expect when selling your online business with the leading brokers in the industry. We’ll explore how these brokers value your business and what kinds of exit multiples you might be able to expect.

This complete guide also includes relevant links to broker resources and a range of free valuation calculators brokers have developed for you to get a baseline value for selling your business.

Best Website Brokers To Get a High Valuation

1) Website Properties

Broker Summary

Website Properties has been brokering businesses for 20 years with a proven sale process for selling e-commerce, Amazon FBA, SaaS, and other unique online businesses.

They boast a success rate of 85-90% for listing and selling businesses to their private network of 35,000 buyers. To date, they have sold over 600 sites worth cumulatively $550M.

Website Properties has a hands-on approach for their deals. They work with sellers from listing to closing the deal and go as far as reaching out to potential buyers themselves. They aim to treat every business listed with them as unique and try to maximize the sale price of businesses listed.

How to Get a Valuation

On Website Properties’s website, their “Free Business Valuation” button leads to a detailed page about their deal process. At the bottom of the page, there is a form to fill in asking for high-level details like business age, annual revenue, and annual earnings. With a few contact details about yourself and a bit about your business, you submit the form and Website Properties team will get back to you with a business valuation.

What to Expect When Selling Your Site

Within days of being listed with Website Properties, they reach out to their network of buyers to boost interest in the deal. As offers come in they help with the deal process to ensure sellers are getting the best offers possible. Website Properties collects a sale commission only when the business is sold.

Website Properties claims to have Amazon and Shopify businesses sold in an average of 6-8 weeks. For more information, read our complete Website Properties review here.

Average Multiples Businesses Sell For

The average sale multiple for businesses sold with Website Properties is 3.5 – 4x.

2) Quiet Light Brokerage

Broker Summary

Quiet Light was founded in 2006 and is widely acknowledged as an expert in the field of selling and buying profitable online businesses. They have successfully sold over 600 online businesses and achieved a total transaction value of over $300,000,000.

Quiet Light values continuous improvement in their deal processes and has found that hiring experienced entrepreneurs to run their deals has led to successful deals.

How to Get a Valuation

Right on Quiet Light’s homepage you can click the green “Get Your Free Valuation” button and be directed to their valuation form. By filling in your business name and URL, plus a few contact details, you’ll be taken forward through the valuation process.

Quiet Light offers a “no-obligation” consultation to discuss your valuation and any other questions you might have in more detail.

What to Expect When Selling Your Site

The Quiet Light process is fairly straightforward as far as brokerages go. Once the business is reviewed by an advisor and lightly vetted, it’s listed for sale to Quiet Light’s private network of buyers. From there, the advisor actively pitches the business to potential buyers.

With their extensive network and marketing team, they have an impressive success rate of selling 85% of their listings in 90 days or less.

For more information, check out our Quiet Light Brokerage review.

Average Multiples Businesses Sell For

Quiet Light’s listings don’t always offer a listed multiple, however, you can do some calculations based on revenue and list price to see what the rough multiple for the business is.

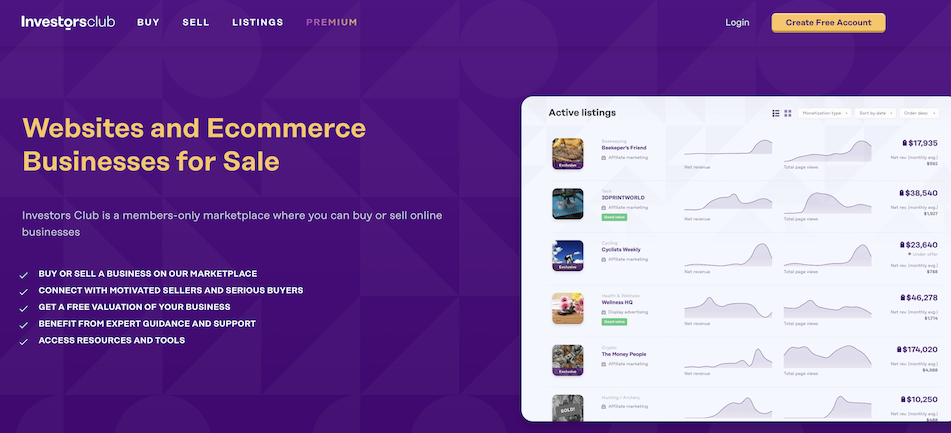

3) Investors Club

Broker Summary

Investors Club is a members-only marketplace where you can buy or sell online businesses. Launched in January of 2020, they’re a fairly new player in the online business brokerage space.

Beyond deal-making, the platform offers additional benefits such as SEO analysis, where experienced professionals review critical ranking factors and provide feedback to attract potential buyers. Sellers also receive a detailed SWOT analysis, which highlights the strengths, weaknesses, opportunities, and threats of their business. This analysis helps sellers present their business in the best possible light to attract potential buyers. Investors Club also provides insights into growth opportunities, helping sellers identify ways to scale and increase earnings potential.

Read our Investors Club review here for more information on how Investors Club stacks up as a broker.

How to Get a Valuation

You can get a free valuation in less than five minutes using Investors Club’s Valuation Tool.

To get started with the valuation process, simply click on the “Start Now!” button located on the page. The more accurate and detailed your answers, the more precise your valuation will be.

Investors Club asks that the revenue numbers you provide are on an accrual basis, meaning they reflect the transactions occurring, rather than a cash basis where money is received or paid out. Additionally, discretionary expenses such as hosting or content creation should not be included in order to not affect the end valuation.

What to Expect When Selling Your Site

For sellers, Investors Club provides a straightforward process to sell their online businesses. They feature low fees, with commissions capped at 7%, making it an attractive option for sellers looking to maximize their profits.

Additionally, Investors Club offers white-glove support to sellers, providing personalized assistance throughout the selling process. They handle all the heavy lifting, including legal documents and asset migration, ensuring a quick and hassle-free experience for sellers.

Average Multiples Businesses Sell For

Investors Club’s valuation page explains that their multiples usually fall within the range of 20 to 50 times the monthly revenue. For example, if your website earns $3,000 per month, its selling price would be somewhere between $60,000 and $150,000.

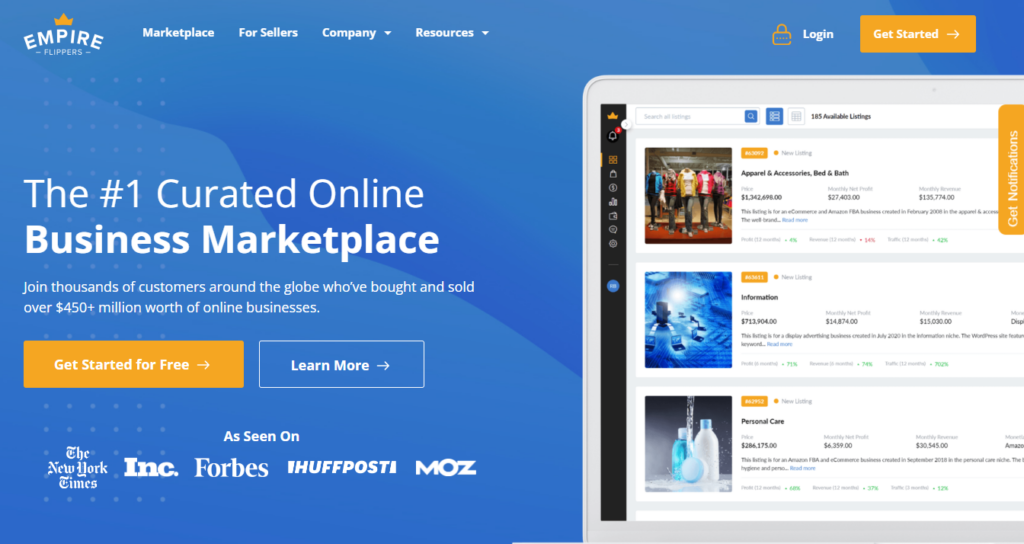

4) Empire Flippers

Broker Summary

Empire Flippers is the leading curated marketplace for buying and selling online businesses. To date, they’ve sold over $465 million worth of online businesses and have over $10 billion in verified buyer liquidity.

With their extensive experience in the online business industry, Empire Flippers understands the needs and challenges faced by savvy business people looking to invest in online assets. They offer a range of services, including pre-vetting listings on their marketplace, a free valuation using their proprietary valuation tool, and a sales team to help support the deal process. They are also the only broker to have an in-house migration process that handles migrating the business from sellers to buyers.

How to Get a Valuation

Empire Flippers has a free valuation tool that allows sellers to get a baseline estimate of how much their business would sell for.

Interested online business owners can do this without submitting their business for sale on the marketplace. To get a valuation, you will have to answer a few questions and input information into the tool. Empire Flippers suggests knowing the following metrics when filling out the tool:

- The date the business was created

- Average monthly gross revenue and expenses

- Average monthly unique visitors

- How many email subscribers you have (if any)

- Number of social media followers (if any)

- Plus, more specific information for some businesses like number of products, downloads, revenue models, etc.

Using this information, Empire Flippers is able to instantly value your business.

Of course, for an official valuation online business owners will have to submit their business for sale. Upon submission the business will be reviewed by the vetting team and if it passes vetting, it will be reviewed for a more detailed valuation.

For a frame of reference, Empire Flippers’s valuation formula typically breaks down as:

[6-12 Months’ Average Net Profit] x Multiple (Typically 20–60+)

Note: Empire Flippers bases their valuations on a “monthly multiple” based on a business’s monthly earnings versus yearly earnings.

What to Expect When Selling Your Site

The average sale duration from start to finish for businesses selling with Empire Flippers is 86 days.

The Empire Flippers process for sellers breaks down to vetting businesses to ensure they’re a good fit for the marketplace, listing the business for sale, the deal negotiation period with buyers, accepting the buyer’s offer and then migrating the business to the buyer.

For more information on selling or buying a business with Empire Flippers, check out our detailed review.

Average Multiples Businesses Sell For

Empire Flippers advertises that their average Sale Multiple: 31.6x (based on a fixed pricing period) and 32.3x (based on a trailing twelve-month multiple).

5) Acquire (Formerly known as MicroAcquire)

Broker Summary

Acquire (formerly known as MicroAcquire) is an online marketplace for startups and online businesses. Founded in 2020 by Andrew Gazdecki, their main goal is to connect qualified buyers to thousands of listings and to get startups sold within 30 days.

Since its inception, Aquire has built an audience of 200,000 founders and buyers. They’ve closed $500M in acquisitions and have raised $6.5M in funding after raising $3.5 million in July 2021.

Acquire isn’t a typical online business brokerage. They have an open marketplace model that is monetized via a yearly $390 premium membership fee for buyers wanting access to new listings. No listing fees are required and the platform has a low 4% closing cost on deals, making Acquire a growing favorite for online business buyers and sellers.

How to Get a Valuation

Acquire allows sellers to set their own valuation for their business when they list on the Acquire marketplace.

Acquire provides overviews on how to value an online business and assures sellers they will give a review of the asking price to ensure it is reasonable enough to entice buyers.

What to Expect When Selling Your Site

The first step for sellers to list with Acquire is to set up an account and begin building their listing. This involves entering basic details about the startup, describing the business, and explaining the reason for selling. Sellers are also encouraged to sync their metrics to provide potential buyers with a comprehensive overview of the business’s performance.

Once the listing is prepared, Acquire’s team of experts steps in to optimize the listing and ensure that it attracts maximum buyer interest. They work closely with the seller to create a perfect listing, leveraging their customer success teams to enhance the presentation of the business. Additionally, Acquire employs multi-channel marketing campaigns to attract a wide range of potential buyers.

Average Multiples Businesses Sell For

Since sellers can set their own listing price, the list multiple varies widely from listing to listing. According to their own marketplace data, here are the multiples they suggest based on monetization:

- SaaS: 2-5x revenue or 4-7x profit

- Ecommerce: 1-2x revenue or 3-5x profit

- Marketplace: 1-3x revenue

- Agency: 1x revenue or 2-3x profit

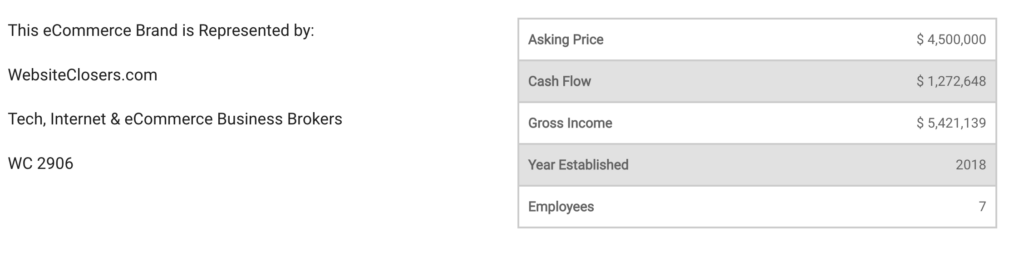

6) Website Closers

Broker Summary

Website Closers has sold a wide array of properties valued from $500,000 to $200,000,000 including software companies, Amazon and eCommerce businesses, Websites and Domains, Technology and IP Companies, Business Services, Internet Businesses, MSP and IT Solutions, Web, App & Software Development, Advertising and Marketing Services

Founded by two experienced online business entrepreneurs Jason Guerrettaz and Ron Matheson, Website Closers advocates for online business owners to help them get the most value for selling their business.

How to Get a Valuation

Website Closers has their own free valuation tool to give sellers a basic understanding of what their business is worth. On their valuation tool page, they explain their formula for valuing businesses:

“The formula we use in this calculation is based on a Multiple of Earnings that is commonly used in valuing many tech companies. Our proprietary algorithm built into this calculator takes into account the world’s largest database of SMB, Lower Middle Market and Middle Market Deal Flow, and includes a blend of valuation methods, including Discounted Cash Flow, Future Maintainable Earnings, Relative, Historical Earnings, Asset Valuation, Comparable Company Analysis, Precedent Transaction Analysis and Straightline TTM Analysis. Our goal in creating this calculator was to provide business owners with a simple tool to help peg a value range for their business.”

Website Closers points out that no tool can fully capture the worth of a business, which is why they offer a free consultation to get a business valuation with a broker.

What to Expect When Selling Your Site

Website Closers lists sites for sale on their Business for Sale page. They also have their own network of qualified buyers that they personally connect to available businesses for sale.

Average Multiples Businesses Sell For

Website Closers doesn’t showcase their direct sale multiple, however, you are able to review their closed deals page to see deals that sold and what their general asking price vs gross income was.

Note: “Asking Price” doesn’t mean the business sold for this price. An Asking Price is most often negotiated down by the buyer and agreed upon by the seller. Always check a broker’s page for actual sale price versus the asking price.

7) FE International

Broker Summary

As an award-winning global M&A advisor, FE International has a proven track record of maximizing sale prices and providing comprehensive services to ensure a convenient and efficient exit for business owners.

FE International’s success in selling businesses is evident through their extensive sell-side experience. They have completed over 1200 transactions, resulting in nearly $1 billion in exit value. FE International has built a network of 80K pre-qualified investors with $41 billion to spend on acquisitions. FEI boasts a 94.1% sales success rate.

With their finger on the pulse of the current market trends, FE International can provide seasoned advice and guidance throughout the selling process.

How to Get a Valuation

By navigating to FEI’s “sell a business” page you’ll find several spots leading to a “free valuation” form. By going through the form, you’ll be set up with a consultation with the FE International team.

What to Expect When Selling Your Site

During the consultation, FEI asks more questions about the business to compile an in-depth valuation.

If the valuation is accepted, the seller moves on to onboarding. The onboarding process involves further data gathering and preliminary due diligence conducted by FE International.

Once the onboarding is complete, the seller’s role becomes minimal until they assist the team of advisors in analyzing offers for the business. FE International offers a full M&A solution, handling inquiries, due diligence, and execution on behalf of the seller. All these processes are managed centrally in a dedicated and secure data room for the business, which is accessible to the seller at all times. Communication with an M&A advisor is also available whenever needed.

Average Multiples Businesses Sell For

FE International does not have a lot of public-facing content on their typical multiples or the value of closed deals, though they have put together some helpful content about how they value businesses. In this article, they break down the valuation factors that led to a 3.5x and 10x multiple for two different businesses. They cite the major influencing factors as “site age, financial trends, competition in the niche and time required to manage as well as the nature of the work required.”

8) Latona’s

Broker Summary

Latona’s is a reputable Mergers and Acquisitions broker specializing in cash flow-positive digital assets. They offer a diverse range of web properties, including content websites, eCommerce businesses, domain portfolios, lead generation sites, membership sites, and SasS businesses.

Latona’s has built an audience of tens of thousands of subscribed investors and has expanded their deal size and close deals from 5-8 figures.

With years of experience and a growing network of investors, Latona’s has established itself as a trusted broker in the industry.

How to Get a Valuation

Latona’s has several online business calculators, broken down by individual monetizations. They have a generalized online business calculator as well as calculators for SaaS, e-commerce, FBA, and Lead Gen websites.

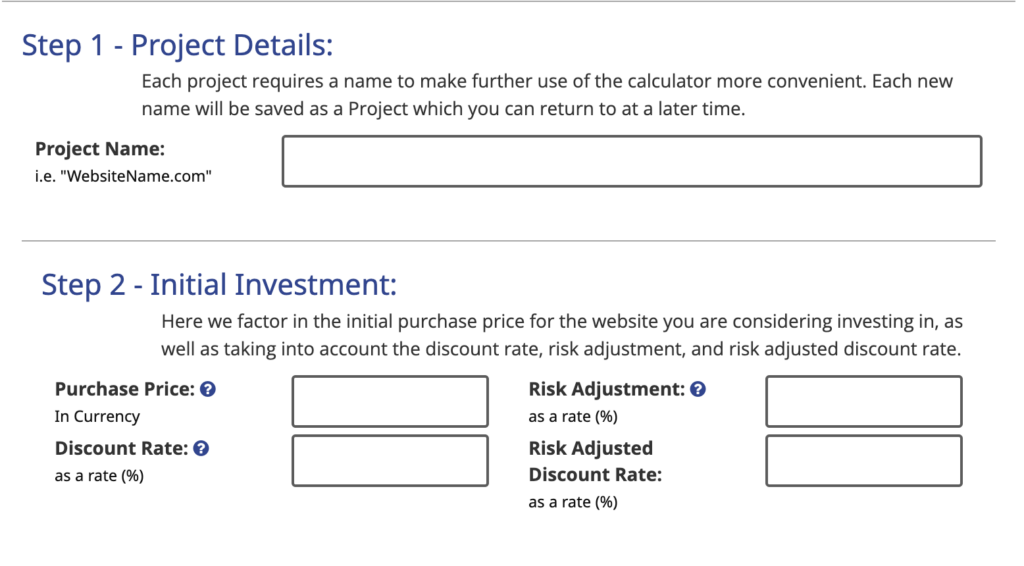

In their general online business calculator, you follow four steps of information to get a valuation. The necessary information and steps as follows:

What to Expect When Selling Your Site

Latona’s has a fairly straightforward sales process similar to other brokerages. After setting up an account, you submit your business information and receive a valuation. If you accept the valuation you then move on to being listed with Latona’s. Latona’s then reaches out to potential buyers, looking for the highest possible bid for the business.

The vetting process can take some time because the responsibility is on the seller to respond to due diligence queries from buyers. Once the right buyer and offer come along, the buyer and seller agree on terms and then handle migrating the business between themselves.

Average Multiples Businesses Sell For

Latona’s publishes their open and closed listings on their site so it’s viewable how much businesses are selling for. While they don’t list their multiples, you can calculate from their asking price versus annual profit what the general multiple would be.

9) Flippa

Broker Summary

Founded in 2009, Flippa is considered to be the oldest platform for buying and selling online businesses. Since its inception, Flippa has sold over 300,000 digital assets and has built an audience of three million.

With over 6,000 listings live on their marketplace, Flippa has a wide range of businesses available for sale in the industry. From apps, domains, Amazon FBA, to content sites, you’ll likely find the business and niche you’re looking for with Flippa.

How to Get a Valuation

You can use Flippa’s valuation tool to get a free estimate of what your business is worth. You submit information about your website such as the URL, organic traffic data, and when the business was started. The tool then automatically gives you an estimated business value.

Your website must be at least 12 months old to use the valuation tool as websites under a year old aren’t established enough to get a reliable estimate.

Like most brokers, Flippa will create a more extensive valuation upon submitting your business to sell with them.

A detailed report will be requested, which should include data such as monthly income, expenses, and any other relevant information for the listing page.

What to Expect When Selling Your Site

For the most part, selling with Flippa means you’ll be quite independent in the deal process. Only for listings above $250,000 will an M&A advisor be assigned to the deal. On deals below this threshold, sellers pay a listing fee that includes services such as marketing for the listing and some customer service support.

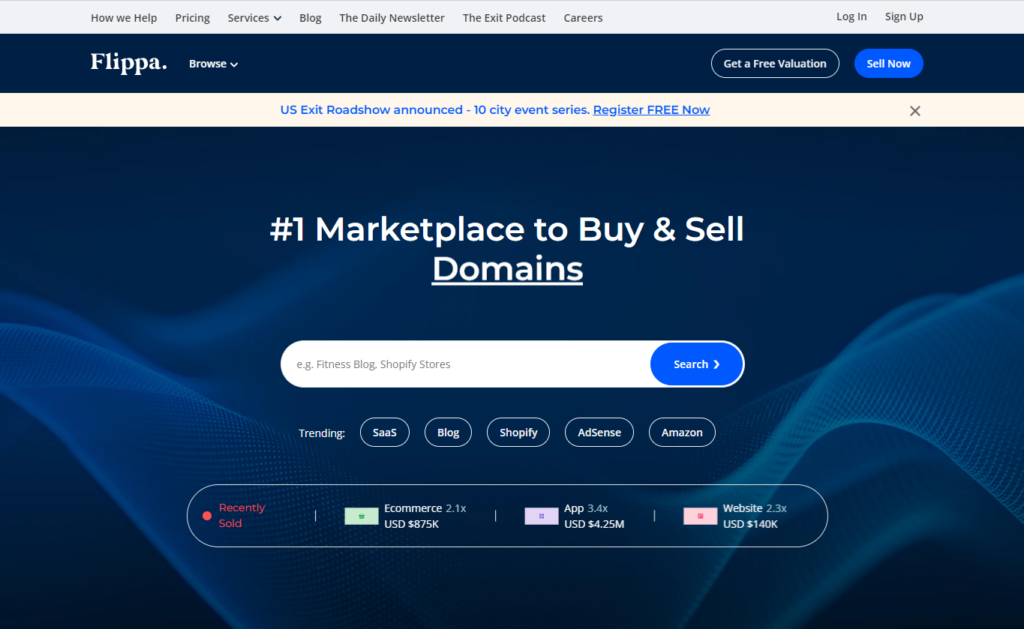

Average Multiples Businesses Sell For

Flippa’s data for businesses sold is vast so it may take some digging to find the exact multiple for a certain monetization.

They have, however, put together a helpful bi-yearly insight report that reveals the data that impacts valuations. In this section they discuss how a business’s age and longevity directly correlate to a higher valuation:

For more information on how Flippa works, read our Flippa review here.

Finding the Right Valuation

In conclusion, using these online business valuation services can help to provide an accurate estimate of what your business may be worth. When it comes time to sell, many offer hands-on support throughout the deal process, ensuring everything goes smoothly.

As with any sale process, it’s important to be up-to-date on the latest industry trends to ensure you’re getting the best return on investment. For more guidance on how to sell your business, check out Acquiring Digital’s expert content to learn more about successful exits.